MCX Commodity Items

Updated on 16-Dec-2023

MCX Commodity, Base Metals, Gold and Silver, Crude Oil, Lot Sizes

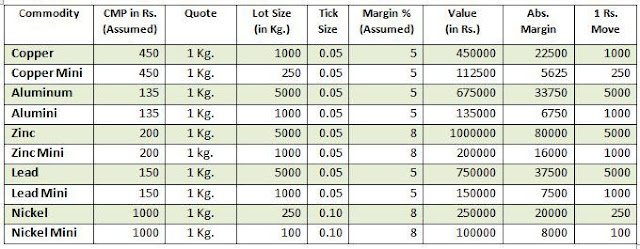

On the MCX exchange, the tradable base metals are – Aluminium, Copper, Lead, Nickel, and Zinc. All base metals have two types of lot sizes – Mega lot and Mini lot. Both types of lot sizes represent the price of metals of one Kilo(Kg.). Mega lot generally requires five times more margin than mini lot and is generally not suitable for small traders.

The base metals margin requirement is set by the exchange and it may change according to the price of the commodity and volatility of that particular commodity. In general, 5% margin money is required for the total value of the commodity. For example, if the Zinc closing price on the exchange was 200 INR per kg. Then the mega lot of 5 tones zinc price will be: 5000x200=1000000 and 5% 50,000. While for zinc mini lot will be 1000x200=200000 and 5% will be 10,000. I assumed a 5% margin but the actual margin is high and it varies every trading day according to the last day closing price on the exchange. The exchange also decides the margin seeing the volatility in that commodity. If you want to know everyday margin requirements you can search on MCX's official website. In the below table, I have shown the details of all base metals commodities traded on the MCX exchange in India.

Tick Size: This means the minimum change in commodity price by which the price can go up or down.

CMP: Current Market Price

Abs. Margin: the absolute margin required to carry over the position, don’t forget to include brokerage and taxes.

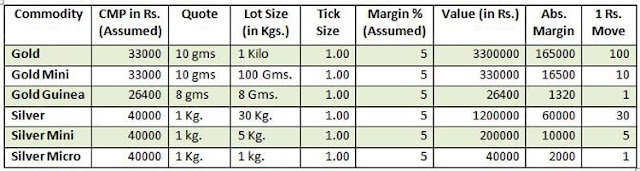

Gold and Silver, also known as bullion, are the most favorable commodities for investors and traders. The government also buys gold as reserve assets like the dollar. Jewelers and women are fond of these metals. There are a variety of lot sizes of Gold/silver traded on the Indian commodity exchange.

Bullion prices are affected by global demand and supply, dollar-rupee movement, and various other factors that may also affect the demand for these precious metals. In time of recession gold demand rise unexpectedly.

A brief table is shown below of different lot sizes of gold and silver.

Crude Oil – It is a natural resource, an unrefined petroleum product with the composition of hydrocarbon and other organic materials. It is a type of fossil fuel that can be refined to produce such as gasoline, petrol, diesel, and various petrochemicals. It is a non-renewable energy source which means it cannot be replaced naturally at the rate we are consuming and therefore it is a limited resource.

OPEC (The Organization of the Petroleum Exporting Countries) – is an organization of five major oil-producing countries and is responsible for controlling crude oil prices in the global market.

On the MCX exchange, Crude Oil is also one of the most favorable and tradable commodities. Two types of lot sizes are traded on MCX – Crude Oil Mega Lot and Mini Lot.

Commodity | CMP in Rs. (Assumed) | Quote | Lot Size (in Barrel) | Tick Size | Margin (%) | Value (Rs.) | Abs. Margin | Per Re Change |

Crude oil | 4061 | Per Barrel | 100 Barrels | 1.00 | 10.39 | 406100 | 42193.79 | 100 |

Crude-Mini | 4061 | Per Barrel | 10 Barrels | 1.00 | 10.56 | 40610 | 4288.42 | 10 |

MCX Commodity Items

Reviewed by Rajesh Kumar Gupta

on

Tuesday, July 16, 2019

Rating:

Reviewed by Rajesh Kumar Gupta

on

Tuesday, July 16, 2019

Rating:

Reviewed by Rajesh Kumar Gupta

on

Tuesday, July 16, 2019

Rating:

Reviewed by Rajesh Kumar Gupta

on

Tuesday, July 16, 2019

Rating:

It was great to see someone write on this topic. Thanks for sharing your thoughts

ReplyDeletemcx trading service