Triple Candlesticks Patterns

Triple Candlestick Patterns

After single candlestick and dual candlesticks let’s focus our attention on the specific formations that consist of three candlesticks in total. These triple candlestick formations help us to decide the trend and price behaviors that are likely to happen next.Some triple candlestick patterns are signals of a trend reversal. Some are continuation patterns that signal a pause in the current trend that may resume in the main trend.

Let’s discuss the popular triple candlesticks patterns :

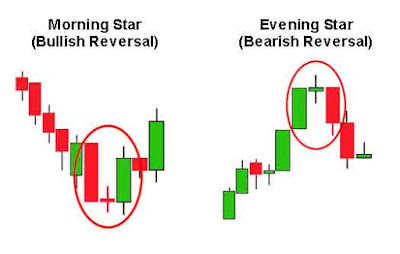

Morning Star & Evening Star

The Morning Star is a three candlesticks pattern. It forms during a downtrend and signals a potential trend reversal to the upside.Recognition Criteria of a Morning Star Pattern :

-

1. The first candlestick is a bearish candle, which is part of a recent downtrend.

2. The second candle has a small body, indicating that there could be some indecision in the market. This candle can be either bullish or bearish.

3. The third candle acts as a confirmation that a reversal is in place, as the candle closes beyond the midpoint of the first candle.

Evening Star

The Evening Star is also a three candlesticks pattern but it forms during an uptrend and signals a potential trend reversal to the downside.Recognition Criteria of an Evening Star Pattern :

-

1. The first candlestick is a bullish candle, which is part of a recent uptrend.

2. The second candle has a small body, indicating that there could be some indecision in the market. This candle can be either bullish or bearish.

3. The third candle acts as a confirmation that a reversal is in place, as the candle closes beyond the midpoint of the first candle.

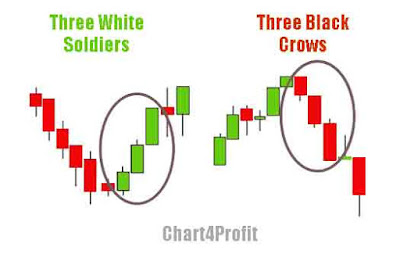

Three White Soldiers

Three White Soldiers means three bullish candles in an extended downtrend Japanese candlesticks chart. It signals that large numbers of bulls have come to revert the downtrend.The first candle is called the reversal candle, a small but bullish candle. The second candle should be bigger than the first candle’s body and it should close high near its top. The third candle should be at least the same size of 2nd candle and have a small or no lower shadow.

Three Black Crows

Three Black Crows Pattern is the opposite of Three White Soldiers and it forms in an extended uptrend and signals a trend reversal to the downside. After discussing Three White Soldiers, it is not important to discuss more on Three Black Crows.The above picture elaborates both patterns in more clarity.

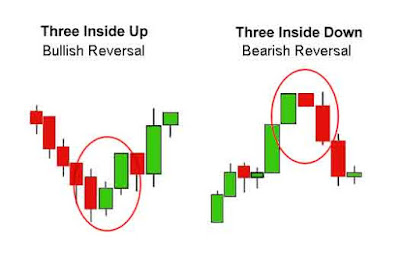

Three Inside Up

Three Inside Up is a bullish trend reversal pattern that occurs in a downtrend and shows that a possible uptrend has started.

Recognition criteria of Three Inside Up :

The first candle should be at the bottom of the trend(downtrend) and it should be a bearish large body candle. The second candle will be a bullish candle and it should be close at least to the mid-point of the previous(first) candle. The third candle needs to close above the first candle's high to confirm that bulls have taken control and have overpowered the downtrend strength.Three Inside Down

Three Inside Down is a bearish trend reversal pattern that occurs in an uptrend and shows that a possible downtrend has begun.

Recognition criteria of Three Inside Down :

The first candle should be at the top of the trend(uptrend) and it should be a bullish large body candle. The second candle will be a bearish candle and it should be close at least to the mid-point of the previous(first) candle. The third candle needs to close below the first candle's low to confirm that bears have taken control and have overpowered the uptrend strength. Reviewed by Rajesh Kumar Gupta

on

Thursday, January 14, 2021

Rating:

Reviewed by Rajesh Kumar Gupta

on

Thursday, January 14, 2021

Rating:

No comments:

Relevant Comments Only, No Abuses Please