LME Inventory Data

Read Also - Importance of LME Data in Metals Trading

Let's assume the LME Inventory: Copper +250, Aluminum -5835, Nickel -669, Zinc +4025, Lead -600

Q: Can anyone help me make sense of this data. From what I have noticed, at times stock reacts sharply to data (i.e. movement as soon as data is released) but quite a few times the data has had no impact on the price (at least on the intraday basis).

How do I interpret LME inventory data?

Ans: Before the actual data is out, there is a forecast of what the inventory level might be. This forecast is done by analysts.If the Actual data is ahead of the forecast or below it, then there is a sharp movement in the commodity price. If the Actual data comes up close to the expected figure, the movement is very minimal.

For Example :

Let's assume the Copper inventory forecast is -250; the actual report comes as +250. Interpretation = there is more inventory than expected. "more stock than demand"...In this scenario, the Copper price would react sharply on the downside

Ans: From the Last Monday in March to the Last Monday in October, it comes out at 1:30 PM IST (Mon-Fri) but due to a change in Day Light Saving Time in the UK, it comes out at 2:30 PM IST (India Standard Time) (November - March).

In the UK the clocks go forward 1 hour at 1am on the last Sunday in March, and back 1 hour at 2am on the last Sunday in October. The period when the clocks are 1 hour ahead is called British Summer Time (BST). There's more daylight in the evenings and less in the mornings (sometimes called Daylight Saving Time).

What is LME?

LME stands for London Metal Exchange, the largest metal exchange for the base and other metals. On this exchange future and options contracts are daily traded, except on holidays. LME provides contracts with daily expiry dates of up to three months from the trade date, weekly contracts to six months and monthly contracts of up to 123 months. The exchange also provides cash trading. It offers hedging, worldwide reference pricing and the option of physical delivery to settle contracts. Since 2012 it has been controlled by Hong Kong Exchanges and Clearing after LME's shareholders voted in July 2012 to allow the sale of the exchange for a price of £1.4 billion. Commodities Traded on LME : The LME offers future and option contracts for the base and other metals like copper, lead, aluminum, zinc, tin, cobalt, nickel, aluminum alloy, molybdenum, steel scraps, etc. What is LME Inventory? LME Inventories are the previous day's data daily released by London Metal Exchange, except on holidays. These are the previous day’s inventory levels of base and other metals in London Metal Exchange(LME) warehouses.Importance of LME Inventory Data :

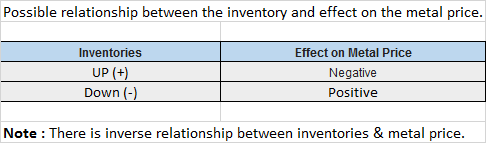

If you are a base metal trader or an investor, this data can be beneficial for you. LME Inventories play an important role to gauge the demand and supply of base metals commodities. If you regularly watch these data you can find an idea of demand and supply in these commodities and you can make a better decision for your investment and short-term trading in base metals. A large stockpile of any commodity indicates slow (less) demand and may affect price toward low while a decrease in inventory indicates strong demand and may affect price toward high. You can understand it from the below table.How to Read Above LME Inventory Data on This Website?

You will find the inventory of only those metals which are traded on MCX. The figures are in Metric Tons and represent the differences from the previous day’s level. A plus(+) sign or Up means an increase in inventory while a minus(-) sign or Down means a decrease in inventory from the previous day.History of LME :

The company was founded in 1877, while the market traces its origins back to 1571 and the opening of the Royal Exchange, London. Before the exchange was created, the business was conducted by traders in London coffee houses using a makeshift ring drawn in chalk on the floor. At first, only copper was traded. Lead and zinc were soon added but only gained official trading status in 1920. The exchange was closed upon the outbreak of World War II and did not reopen for copper trading until 1953. The range of metals traded was extended to include aluminum (1978), nickel (1979), tin (1989), aluminum alloy (1992), steel (2008), and minor metals cobalt and molybdenum (2010). The exchange ceased trading plastics in 2011. The total value of the trade is around $US 11.6 trillion annually. Many deals are made for commodities to be delivered in three months' time. The custom stems from the time that copper cargoes originally took in 1877 on their voyage from the ports of Chile. The LME was owned by its members until 2012 when it was sold to Hong Kong Exchanges and Clearing for £1.4 billion. (Content Source: en.wikipedia.org) website link: https://en.wikipedia.org/wiki/London_Metal_Exchange Reviewed by Rajesh Kumar Gupta

on

Friday, July 24, 2020

Rating:

Reviewed by Rajesh Kumar Gupta

on

Friday, July 24, 2020

Rating:

I have find it many times that on this site LME data is posted without much delay.

ReplyDeleteHow LME Inventory report helps in metal trading?

ReplyDeleteIs there any fixed time for daily inventory on each base metals?

ReplyDeleteYes .. it is 1:30 PM according to Indian Standard Time (IST), but it may change as per Daylight Saving Time.

Deleteall base metals inventory data come at the same time ..

Deletehow to covert USD to INR for all metals...

ReplyDeletePlease Read 'How to Read Above LME Inventory Data on Our Website?' section.

DeleteWill I get report for same day or one day back report

ReplyDeleteLME inventory is previous day inventory change provided by LME.

Deletei think nickel inventory data wrong

ReplyDeleteThanks for your comment ... as we do not get data directly from LME, so error(s) are possible. Although we verified it from other sources and corrected it.

ReplyDeleteHello, Pls share pricing for daily update. Ty

ReplyDeleteShare your payment detials on whatsup

ReplyDelete9097359546

Delete@9959997687

ReplyDeleteHello Rajesh, Pls let me konw your whatsup number for payment. Ty

ReplyDelete9097359546

ReplyDelete