Updated: 22/04/2019 at 3pm

The question is – has zinc changed its trend or is it still in an uptrend?

I tried to find the answer to my question analyzing zinc chart on the different time-frame and its closing price on Thursday.

We have seen that in the last few hours of trades zinc gave a little bounce-back from day's low and maintained the bounce.

Monday on 22th of April 2019 there is a public holiday on London Metal Exchange (LME), so on MCX base metals price may trade in a tight narrow range.

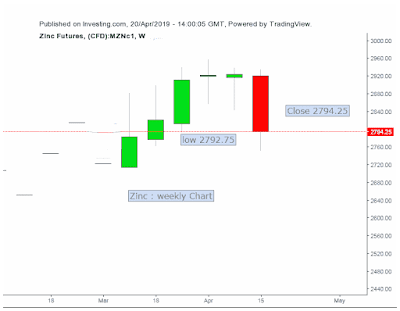

After inventory rise in zinc on LME, last week zinc touched low of 2751.25. Its weekly high was 2934.75 and a weekly low is 2751.25, a decline of 6.25% from weekly high and managed to close at 2794.25, means almost of 4.78% weekly loss.

The question is – has zinc changed its trend or is it still in an uptrend?

I tried to find the answer to my question analyzing zinc chart on the different time-frame and its closing price on Thursday.

We have seen that in the last few hours of trades zinc gave a little bounce-back from day's low and maintained the bounce.

Let's first look at the zinc chart –

On the daily chart, it has breached the trend-line, as you can see in the above chart.

After analyzing the chart on a weekly basis, I found that zinc is still under uptrend and price may consolidate between narrow range for one-two days after then zinc may show again upward momentum. If you will closely watch the chart of zinc on weekly time-frame you will see that although it breached the weekly low but managed to close just above the low of that. Long term demand in zinc looks positive and price may move up after a little consolidation.

Monday on 22th of April 2019 there is a public holiday on London Metal Exchange (LME), so on MCX base metals price may trade in a tight narrow range.

Declaimer: This is just my personal opinion and not any trading advice.

Zinc Trading Strategy for next week

Reviewed by Rajesh Kumar Gupta

on

Saturday, April 20, 2019

Rating:

Reviewed by Rajesh Kumar Gupta

on

Saturday, April 20, 2019

Rating:

Reviewed by Rajesh Kumar Gupta

on

Saturday, April 20, 2019

Rating:

Reviewed by Rajesh Kumar Gupta

on

Saturday, April 20, 2019

Rating:

No comments:

Relevant Comments Only, No Abuses Please